|

|

Loan Servicing Software for

|

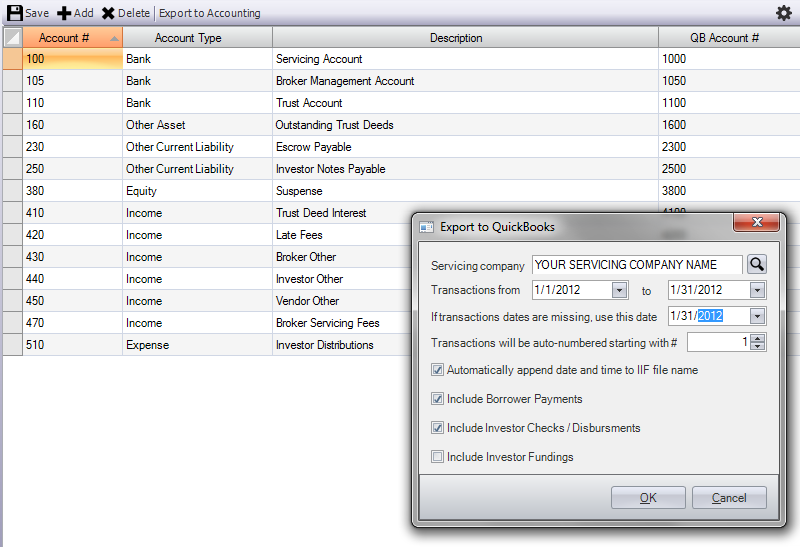

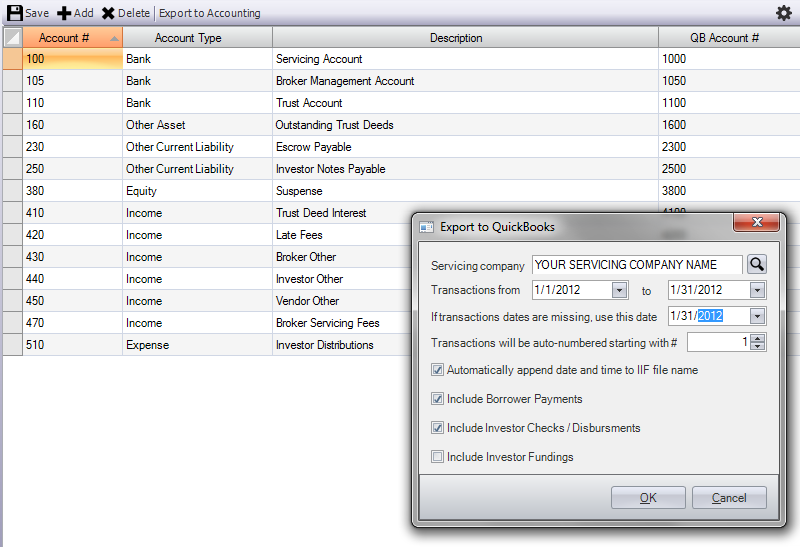

These screenshots showcase our setup screen, which enables export of transaction data to QuickBooks:

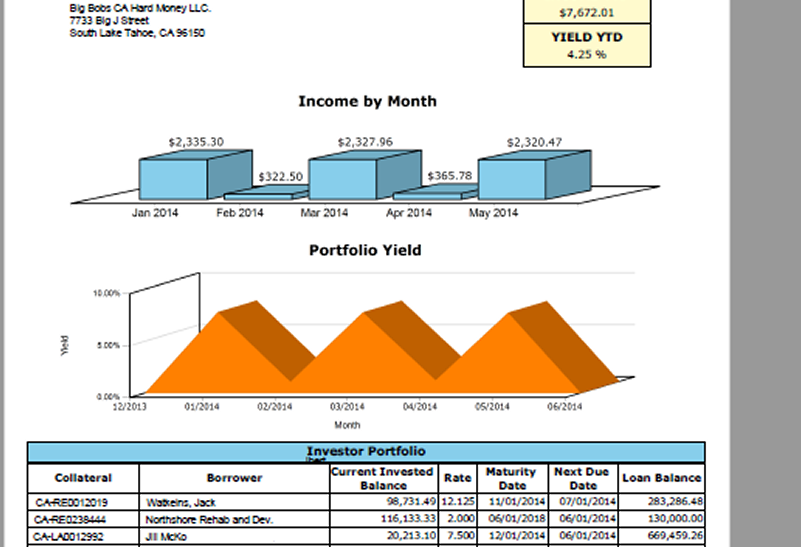

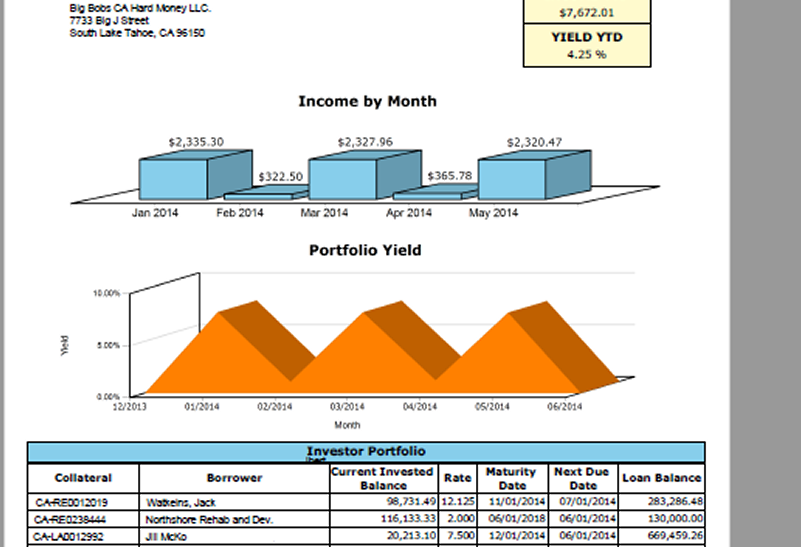

And here you can take a look at our Investor Reporting example:

|

|

Loan Servicing Software for

|

These screenshots showcase our setup screen, which enables export of transaction data to QuickBooks:

And here you can take a look at our Investor Reporting example: