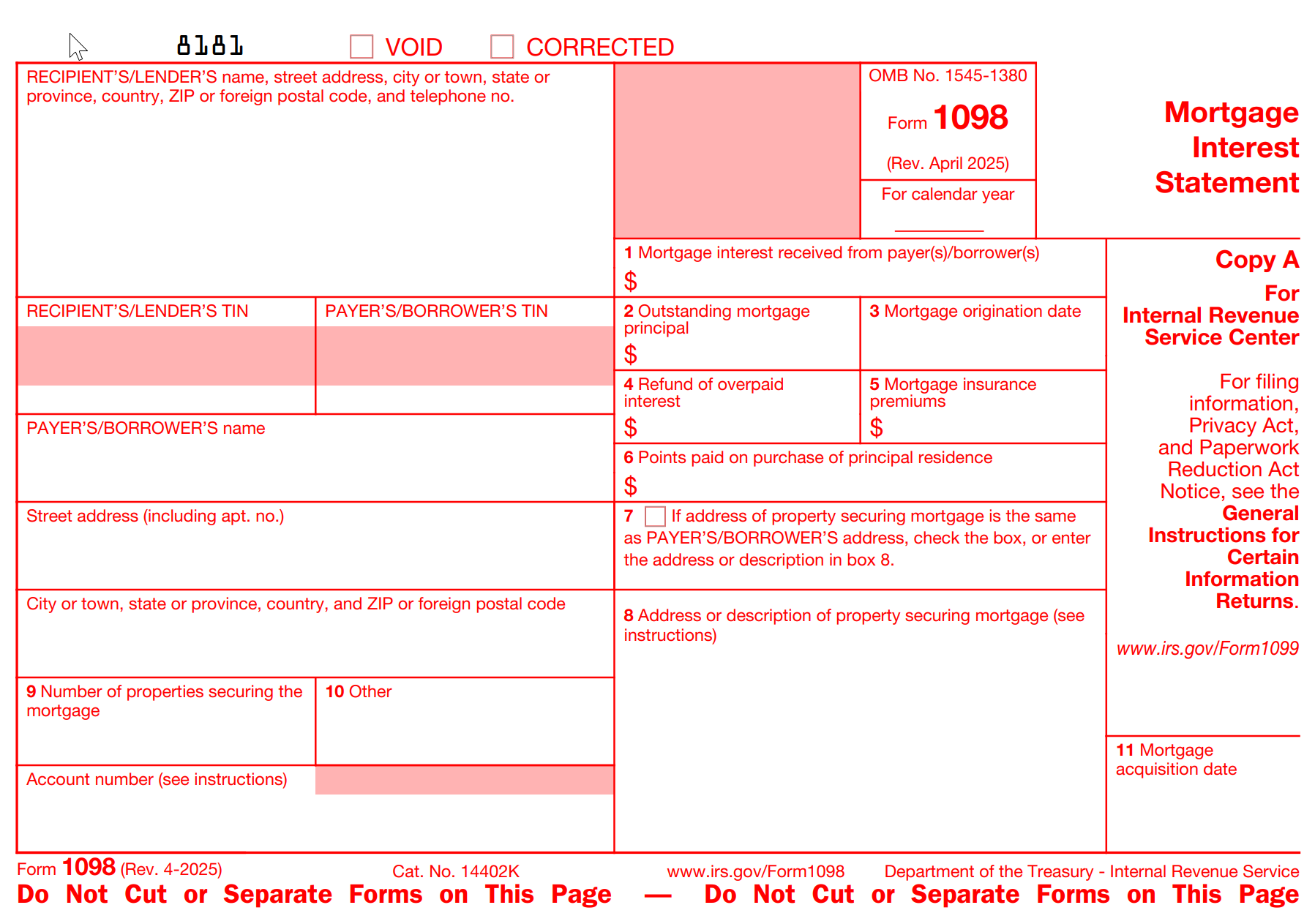

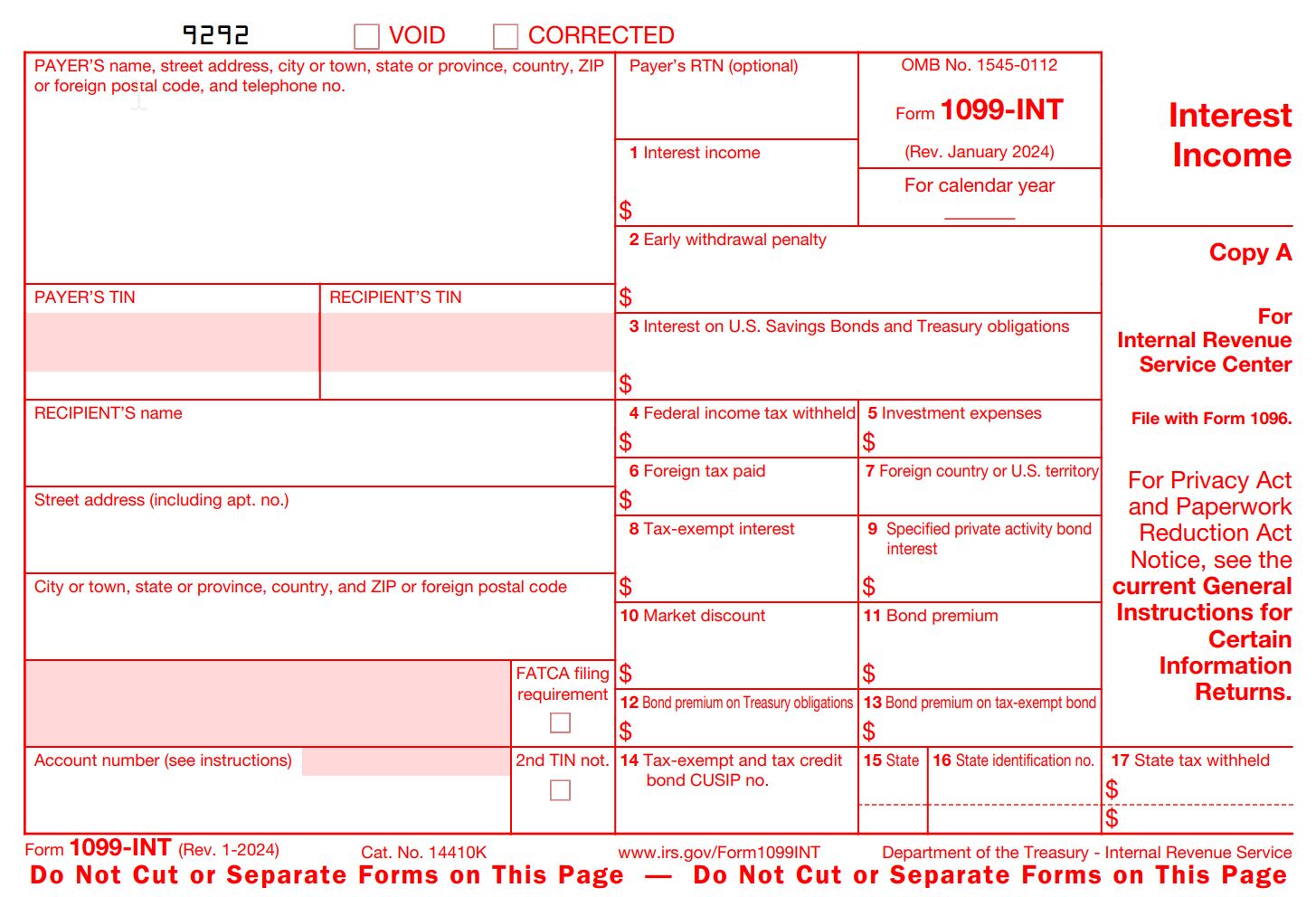

1098, 1099-INT E-File / Filing for 2025

***The deadline for 1098, 1099-INT E-File is March 31, 2026***

***You must now E-File if you have 10 or more 1098 and/or 1099-INT forms***

Below are options and instructions.

- Unlimited E-File for $499.

- $499 for an unlimited number of 1098 and/or 1099-INT's.

- This is a perfect solution for private lenders with investors.

- A one stop shop for E-Filing both your borrower 1098's and your lender/investor 1099-INT's.

If you are a LSS licensee

If you are a current LOAN SERVICING SOFT licensee and

interested in starting the process please see this How To Doc,

submit a ticket & upload your files. We will send you payment

link once we have processed your order.

File Upload: Secure Upload

If you are NOT a LSS licensee

All you need to do is fill our agreement, enter your data

on one or both of the spreadsheet documents & upload

using the secure link. We will send you payment link once

we have processed your order.

E-File Agreement

1098 Spreadsheet

1099-INT Spreadsheet

File Upload: Secure Upload

YOU SHOULD NOT E-FILE WITH US

If you trying to E-File 1099-MISC or 1099-NEC. You should use QuickBooks or contact a

tax professional.

REASONS YOU SHOULD E-FILE (AND E-FILE WITH US)

E-Filing is the way of the future, so make the switch as soon as you can.

If you are doing 10 or more 1098 and/or 1099-INT's, YOU ARE

REQUIRED to file electronically, "E-File".

Let the 1098, 1099-INT E-File Professionals take care of it. We have been doing 1098, 1099-INT

E-Filing for over 40 years, mostly for private lenders with trust deed investors.

We do both the 1098 & 1099-INT E-Filing. Perfect for private lenders with investors! All

for the a flat $499 (For up to 10,000 E-File contacts).

E-filing saves both you and the IRS time. For you, there's no printing forms, filling

them out by hand, or going to the post office. For the IRS, there's no need to transcribe each paper return.

In the case of Form 1096, you can't just print out the form yourself. Form 1096 must be scannable by IRS processing systems, so they require you to order the form in advance. Takes 10 business days to arrive.

E-Filing is Accurate and Secure. There's a great deal more room for error with the paper method of filing your tax returns. When you make a mistake E-Filing, you'll be able to see it right away as opposed to waiting for the IRS to receive the information by mail. And on the IRS's side, their employees need to manually type each tax return into their system, leaving plenty of room for human error.

An encrypted network is much more secure and reliable than sending returns through the postal service. E-Filing systems are encrypted under IRS guidelines using strong encryption programs.

E-Filing is Sustainable. Filing paper tax forms each year uses up a lot of paper. If you are trying to be a more environmentally conscious business, efiling is the way to go.